Benjamin Franklin once said “In this world nothing can be said to be certain, except death and taxes.”

Today I’m going to talk about the second certainty on his list, taxes.

Today I’m going to talk about the second certainty on his list, taxes.

Every so often I like to check the income tax rates in Australia and compare them to those in the UK. Last time I did this was for the 2013/14 tax year in my post called Australia versus the UK; Taxes and Pensions.

If you check back on that older post, you’ll find some interesting information about pensions and Australian superannuation which I won’t repeat again in this update. All we are interested in here is the current tax rates for individuals.

Here they are:

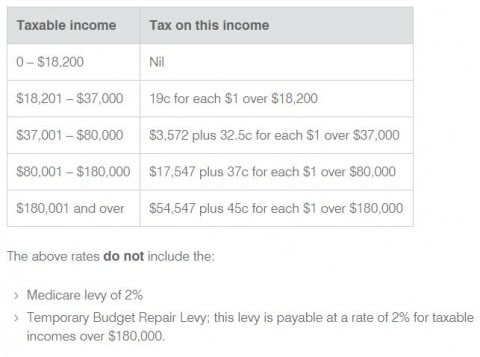

Individual income tax rates for Australia applicable for tax year 2015/16

Image courtesy of the ATO.

Image courtesy of the ATO.

Update for tax year July 2016 to June 2017

The Government announced that from 1 July 2016, for individual taxpayers, the marginal tax rate of 37 per cent will start at $87,000 instead of the current $80,000.

This new threshold will also apply to foreign residents.

Please adjust the table above for tax calculations for 2016/17.

- For all the latest updated tax rates, please visit the Australian Tax Office website.

………………………………………….

Back to the original post and 2015/16.

To save you checking back, I can confirm that these tax rates are absolutely no different from two years ago. So the good news is that the percentages of tax payable haven’t risen, the bad news is neither have the tax free thresholds.

What is very different though is that our Medicare levy has gone up from 1.5%, to 2%.

UK and Australia tax rates compared

As I’ve mentioned before, comparing tax rates is a ridiculously difficult thing to do for so many reasons. Each of our countries has taxes for other things, like house purchases. And then the UK has VAT, whilst Australia has GST.

Also, what you get for your tax dollars varies between our two countries. For example, the UK’s NHS offers more comprehensive health cover than Australia’s Medicare.

Bearing all this in mind though, we can still do a straight comparison on individuals income tax payments combined with the UK’s National Insurance and Australia’s Medicare levy.

And these comparisons can be made real easy with the help of the free online tax calculators available for both our countries. So, let’s do it.

For some time now, the average full-time wage in Australia has been around the $70,000 mark, so let’s work with that.

Now all I need to do is punch that number into taxcalc.com.au who will work it all out for me…

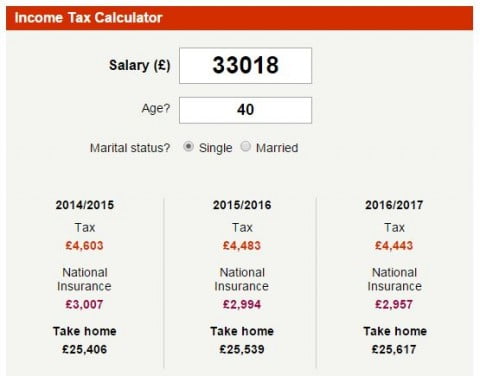

As we speak, the exchange rate is one GBP = 2.12 Aussie dollars. By my maths, that means $70,000 is equivalent to £33,018.

So now I need to punch that number into The Telegraphs Income Tax Calculator and quick as a flash they will tell me…

By the way, age makes no difference other than if you are over 67, you would no longer pay National Insurance.

By the way, age makes no difference other than if you are over 67, you would no longer pay National Insurance.

Conclusion

- In Australia, your income tax and Medicare levy combined is $15,697

- In the UK, your income tax and National Insurance combined is £7479

£7479 converted back into Australian dollars at the same exchange rate is $15,855.

Therefore, in Australia, you pay $158 a year less than in the UK.

- But then, as mentioned, our health service isn’t as comprehensive as the UK’s NHS.

- But then again, our GST is 10%; VAT in the UK is currently 20% at the standard rate.

- Also, here in Australia, employers do have to pay an extra 9.5% of income into the employees Superannuation account (pension) for every employee earning more than $450 per week.

Where would you be better off?

I don’t know, but there really doesn’t seem to be very much in it.

Final word

Australia’s leaders, that’s federal government and state government, met recently to discuss ways of increasing taxes in Australia. Apparently there just isn’t enough money going into the pot at the moment to take care of the rising health services costs.

So, possible solutions currently being proposed are raising GST from 10% to 15% or raising the Medicare levy another 2% to 4%. Other options include increasing property taxes or income tax itself.

Nothing has yet been decided, but here in Australia I think we can add a third certainty to our earlier discussed shortlist.

Taxes will be going up.

As a dual USA/Australia citizen looking at moving to Oz, I’m having a hard time understanding how bad the tax consequences will be for my case. One significant aspect is I’m a self employed software consultant and my clients will mostly *not* be in Australia (I work via the internet). Any suggestions for a suitable tax lawyer or accountant who can help me with this, and/or has anyone else already looked into this kind of situation?

I’m not so sure you will need any kind of specialised tax agent for this, I think it’s quite a common situation. You want to choose one close to where you’re going to live in Australia so at least you can go and see them at their offices if you need to.

It’s good to be able to eyeball them sometimes.

You may also have to maintain an accountant in the US and your task will be to prove in which country you are resident, as I believe you will need to pay tax on your earnings in the country where you are deemed to live. That may depend a bit on the type of visa you come here on. You will probably have to jump through some hoops to get the US tax office off your back if you are deemed to live here, I know I did to get the UK tax office off of mine.

So, I can’t give you a specific recommendation, but I don’t see this as being a huge problem to resolve. That said, I’m not an accountant and I have no idea 🙂

Hope I’ve helped a bit though, good luck, Bob

Thanks Bob. For what it’s worth US citizens have to file US taxes forever no matter where they live. We’re special in that way. 🙂

Crikey, that’s a very long time. 🙂

A bit more than two years later, I have finally lodged my first Australian tax return. 🙂

As noted earlier this is complicated considerably by the obligation of U.S. citizens to also file a U.S. return no matter where they live. I hope you don’t mind if I just point to a write-up of my experience here:

https://in-oz.com/bb/viewtopic.php?f=5&t=36&p=57

Cheers, Rod

No, that’s fine, filling in tax returns is a nightmare at best of times, let alone having to do a couple of them.

Hi bobinoz, I’m thinking of emagrating & trying to find out how much the costs for state special needs schools many thanks

All the information I have about schools, and I have quite a bit, you’ll find on my page called Which school? Be sure to check out the additional links at the bottom.

I’ve not written anything about special needs schools, but if you post a comment there and mention specifically what the special need is, then maybe somebody can help you.

How about sick pay and pension? Uk sick pay is rubish and pension is very low.

It’s complicated, but similar to elsewhere, it depends who you work for and how much you put into your pension, called ‘super’, short for superannuation, here in Australia.

For sick pay, see…

https://www.bobinoz.com/blog/12082/chucking-a-sickie-australia-and-uk-compared/

My son is already settled in Australia.i have one son and three daughters.out of three two r settled in India and one is in u.s.a..can I get long term visa for australia to stay with my son.pl.advise.

See Would I Qualify?