A story of swings and roundabouts.

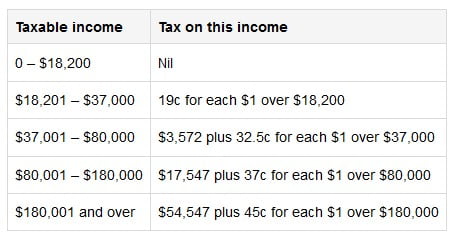

The last time I wrote about income tax rates here in Australia and compared them to those in the UK was back in October 2009. At the time, these were the tax bands in operation here in Australia.

Old tax rates now out of date…

On 1 July each year the Australian Tax Office (ATO) can change these rates and last year they made significant changes, but this years tax rates are the same as 2012/13. Let’s take a look to see how different they are from those of 2009/10.

On 1 July each year the Australian Tax Office (ATO) can change these rates and last year they made significant changes, but this years tax rates are the same as 2012/13. Let’s take a look to see how different they are from those of 2009/10.

Individual income tax rates for Australia applicable for tax year 2013/14

Image source: ato.gov.au

Image source: ato.gov.au

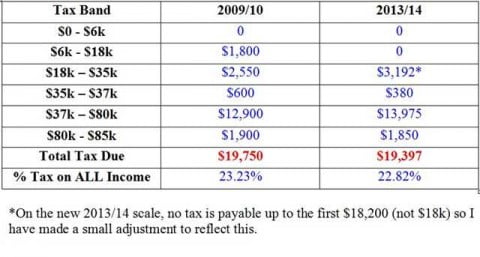

Are these tax rates better for individuals than they were three or four years ago? Let’s do an example.

I decided to pluck out an annual salary of $85,000, this represents a slightly higher than national average, the current national average is about $68,000-$70,000. I went for $85,000 because I wanted it to spread across four of the five income tax thresholds.

In this table I compare the tax you would have paid back in 2009/10 to what you might expect to pay in 2013/14.

Australian Taxes: Old Rates vs New

So the more recent tax bands here in Australia are a little kinder on the pocket, probably more so on the lower paid due to the $18,200 per year Zero tax threshold. But even higher paid earners will not pay more tax under this system, so Australian taxes have actually gone down.

So the more recent tax bands here in Australia are a little kinder on the pocket, probably more so on the lower paid due to the $18,200 per year Zero tax threshold. But even higher paid earners will not pay more tax under this system, so Australian taxes have actually gone down.

Hurrah! Taxes are down!

On the downside though, it wasn’t a lot, was it? But it’s better than nothing.

If you can’t be bothered to work it all out for yourself, there is an online tax calculator that will do it for you…

…it was pleasing to see that it came up with the same answer as I did on the above $85,000 per annum income example.

It also pointed out, as I am going to as well, that this does not include the 1.5% Medicare levy, so you will need to fork out an additional $1,275 for that in this example.

A comparison with the UK

To compare these tax payments to the UK, I first had to calculate how much $85,000 AUD would be in pounds. Currently one GBP is worth 1.66 AUD and on that basis $85,000 is equivalent to £51,204.

I then nipped over to a UK tax calculator site called listentotaxman and popped that figure into their box as an annual salary. I used the tax code 117L as I understand this is the standard individual person’s code and means that no tax is paid until earnings exceed £1,170 per annum.

Update:

Please refer to the first comment made below by Nick Logan.

Nick has kindly pointed out that the code I originally used here, 117L, is for those with considerably reduced tax allowances. He has also provided a link to HM Revenue & Customs showing that the Personal Allowance for people under 65 is £9440, code 944L.

This does make quite a difference, which he also explains. On that basis I have decided to change my conclusion and use code 944L instead. Back to the article…

That threw out a couple of interesting numbers, firstly the tax due would be £10,300. This is equivalent to $17,098 and is therefore around $2,299 a year less than here in Australia.

It also went on to say that £4,238 ($7,035) would be payable under National Insurance, this covers (if I remember correctly) the National Health Service (NHS) and also includes contributions towards the state pension.

Conclusion

In this example, those in the UK pay around $2,299 a year less in tax and $7,035 a year more in National Insurance. That’s a total of around $4,736 more in tax overall.

So although us Australians would appear to be $4,736 better off, we do need to pay that Medicare levy of $1,275.

That leaves us about $3461 to the good, just about enough to pay for the average family’s monthly medical insurance cover of around $250 a month.

That still won’t cover every medical expense though, prescriptions (or scripts) are not free here and you will probably need to pay every time you visit a doctor. Mine charges $80, but I do get a Medicare refund that gives me back about half of that.

Luckily, I have $461 to spare that will hopefully cover those extra expenses.

Reminder: This applies to the above example only, as Nick and now I have pointed out, you need to know your exact code to make a meaningful comparison.

What about pensions in Australia?

I really don’t understand too much about pensions either here or in the UK, but here’s what I think I know. If I’ve made any errors, please feel free to point them out. On that basis I strongly suggest you check the following information with an expert if you really need to know exactly how it works, but, as I say, this is my understanding of the situation.

Here we have what’s called Superannuation, or just plain Super. It is the responsibility of the employer to make these contributions, currently 9.25% but rising each year until it eventually hits 12%, but as an employee you can voluntarily top that up if you want a better pension.

But, on the other hand, you don’t have to either.

Now, I might not be sure of what I’m saying when it comes to pensions, but I’m sure the Victorian Government are fully aware of the rules. Over on their website, I found this…

Superannuation

Australia has a compulsory pension (retirement) savings scheme known as superannuation, or ‘super’. If you are paid A$450 or more each month, your employer must pay a further nine percent of your wage into your superannuation fund or retirement savings account. The amount should be in addition to your regular salary but some employers advertise a role inclusive of superannuation. Your superannuation cannot be accessed until you retire, usually at the age of 60-65.

Source: liveinvictoria

How good is an Aussie pension compared to a UK state pension? Again, I don’t know, but if you do maybe you can let us know in the comments below.

The bottom line though is that on the face of it, Australians seem slightly better off tax wise, but I’d never suggest that they definitely would be because taxes are far too slippery for that.

One minute we are paying the carbon tax here, the next we are not, but we are paying some other kind of contribution. We have GST, you have VAT, some of us here have flood taxes and I even had a comment from someone who lives in Phoenix in the USA, saying he has to pay a contribution of $1,000 a year towards his local fire department who are privately run.

By their very nature, taxes are very difficult to understand in whichever country you live. So, would you be better off tax wise he in Australia or not?

I hate it when anyone answers a tricky question with “how long is a piece of string?”, but would it be okay to me to say it’s probably “swings and roundabouts”?

For an update on this post, please see…

Hi Bob,

So, if i move to Oz permanently and my only income is my NHS pension, will this be taxed at marginal progressive rates? Currently these are 0-$18200 – no tax, 18201 – $37000 – 19% tax etc.

Is my understanding correct?

cheers,

Jon

Yes, I believe so, but it is very complicated. I think you would need to speak to a pensions expert about it to get the full picture and, of course, I’m sure they would be able to advise you so that you do not pay any more tax than you need to.

Hey again .. my employer will be paying superannuation, would I be able to access that money if I moved back home after a year for example?

I think you would probably need to talk to a pensions expert about that, I’m sure you would get something, but probably not a lot after just one year.

Hi Bob just read tax here or UK but nore thing not mentioned is Medicare Levy Surcharge for higher tax payers on 457visas there is no way to escape that charge

This is a direct comparison of tax payable in each country for permanent residents, it’s not applicable to any temporary visas. In my update I do mention the Medicare Levy…

https://www.bobinoz.com/blog/17873/individual-income-tax-rates-australia-and-uk-compared-201516/

Hello. This sits outside income tax and goes into the realm of the cost of living, meaning, for example,in Australia you need private health insurance (among other things). Its a lot more socialist in the UK and the benefits appear to be higher (NHS covers quite a bit). UK also have the BBC tax … plus you don’t seem to be able to claim as much back on your tax in the UK (Australia seems so much nicer when it comes to deductibles). At the same time, you would also in the UK get an additional allowance from your employer in your salary for working in London. So perhaps once you take everything into account (after tax/bills), your income for saving/living could be fairly similar?

Yes, it does go beyond just income tax, I like to over deliver 🙂

You’ve made some good points Sarah, and all these things need to be taken into consideration. I’d just like to correct you slightly on one thing though, in Australia you do not ‘need’ private health insurance. It is optional, unless you are here on some kind of temporary visa for which the condition is that you take out health care cover. That is to say, the temporary visa will not cover you for public health services.

To answer the question, how long is piece of string?

Twice as long as it is from the middle to the end.

Love your blog!

Aargh! That’s even more irritating than the original phrase! But if someone ever answers one of my questions with “how long is a piece of string?” again, that’s exactly what I’m going to say back at them 🙂

No problem. I’ve enjoyed reading your blog for a while now and if I see anything that doesn’t look quite right, I’ll let you know. My perspective may be different to most of your readers as I’ve come over on a parental visa and am retired.

Cheers,

Nick

Thanks Nick, it’s appreciated.

Cheers, Bob

Hi Bob,

I think you have overestimated the UK tax burden. I don’t know why you chose a tax code of 117L as the standard tax code is actually 944L. If you’d entered 944L or just left it out, the tax calculator would have shown the tax paid to be £10303 or $17102 so UK tax is about $2300 less. Adding in the NI and Medicare costs leaves the Australian approx $3400 better off, just enough to pay for health insurance.

Hi Nick

If I’ve got it wrong, then I certainly need to know about it as I don’t want to mislead anyone. Thanks for providing this information, the code of 117L came from the HM Revenue and Customs website who describe it as…

For example, the tax code 117L means:

– you are entitled to the basic Personal Allowance

-£1,170 must be taken away from your total taxable income and you pay tax on what’s left.

The Australian tax deductions I am comparing it to are for ‘individuals’ by which I believe they mean no wife or children or anything special to claim for.

I assumed they would be equivalent, could you tell me what 944L code is for?

Cheers

Bob

If you look at http://www.hmrc.gov.uk/rates/it.htm you will see that the Personal Allowance for people under 65 is £9440 which translates into a tax code of 944L. I think that the reference you have found to 117L is simply using that as an example of how to convert back from a tax code to a Personal Allowance. If you actually had a tax code of 117L it would mean that you had a considerably reduced tax allowance due to unpaid tax or taxable benefits.

I’m no expert here but before migrating to Australia 16 months ago, I had a tax code of 747L for tax year 2011-12 which corresponded to the Personal Allowance for that year of £7475. I hope that helps.

Cheers,

Nick

Thanks Nick, I have now completely updated that part of this post, and I really do appreciate you taking the time to point this out. Hopefully it is now more accurate, but as I have said, everybody should check their exact personal tax position both in the UK and here in Australia to make a relevant comparison.

Cheers, Bob