It’s been quite some time since I last took a good look at house price comparisons between these two countries, maybe too long. So let’s put that right today.

The problem with these comparisons though is, where do you get your information from? The last time I looked at Australian prices in my post called Australian House Prices: Capital Markets Report 2013, the information came from RP Data. But building societies, governments, institutions and organisations all report on house prices and come up with differing figures.

Then there are averages, means, medians, weighted averages, mix-adjusted and seasonally adjusted figures. Throw in the ever-changing currency exchange rates and different average earnings for each country, and the task is almost impossible.

But today though we will try and look at the variation in prices between our two countries and the cities and the regions of each.

House prices in the United Kingdom

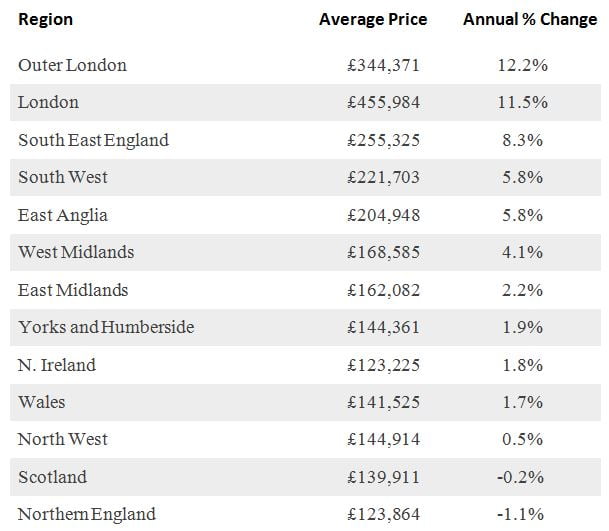

We will start with the UK. I recently came across a headline saying prices of houses in the south of England were almost double that of houses in the north.

The following figures were produced by Nationwide and released at the beginning of this month, so are valid as at the end of Quarter 1 of 2016. They are described as average prices over the last 12 months:

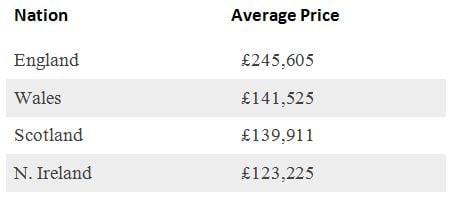

As you can see, prices vary enormously across the UK and from nation to nation. Here is a smaller chart of the current average house prices for each of the four nations that make up the UK:

As you can see, prices vary enormously across the UK and from nation to nation. Here is a smaller chart of the current average house prices for each of the four nations that make up the UK:

Source: Nationwide. Clicking on the following link will open their full PDF report.

Source: Nationwide. Clicking on the following link will open their full PDF report.

The Office of National Statistics (ONS) see it differently; these are the figures they had in February 2016, which they describe as a ‘mix-adjusted average house price’:

Source: ONS.gov.uk

Source: ONS.gov.uk

As you can see, even though both the ONS and Nationwide are using averages, the ONS prices are considerably higher. Now let’s turn our attention to Australia.

House prices in Australia

Just as in the UK, Australia’s house prices vary considerably from city to city and region to region. The following figures were produced by the Real Estate Institute of Australia (REIA). They describe them as the ‘weighted average median house price for eight capital cities at December 2015 quarter.’

The percentage price fluctuations are for the December 2015 quarter:

- Sydney down 2.5% to $1,025,478

- Melbourne down 0.1% to $718,000

- Darwin up 0.5% to $608,750

- Canberra up 3.7% to $593,000

- Perth up 0.4% to $535,000

- Brisbane up 3.2% to $490,000

- Adelaide steady at $430,000

- Hobart up 9.8% to $392,000

- Australian median house price $695,788 (down 0.4%)

As you can see, again prices vary massively across the country. Additionally, all of these prices are for our capital cities, we still have plenty more houses in rural and regional Australia. This information is harder to find, but I did do a search for all houses in Australia costing $250,000 or less with a minimum of three bedrooms, state-by-state.

Here’s how many houses were available today:

- New South Wales – 3,765

- Victoria – 4,385

- Queensland – 6,547

- Western Australia – 1,528

- South Australia – 3,181

- Tasmania – 1,736

- ACT – 5

- Northern Territory – 30

I didn’t check every house to make sure that they all fit with the criteria, but as you can see, there seems to be plenty of three-bedroom houses to choose from that cost less than the equivalent price of some of the cheapest houses in the UK. Remember, these are houses, not flats, apartments or units.

A note on averages and medians

Some dedicated statisticians among you may suggest that all of this information is useless as the UK talk about averages and Australia medians. I wholeheartedly disagree, I think when there is this much data, as in thousands of houses, the difference between the two is diminished.

These are the only figures I could find to work with though, so there was no other choice.

Conclusion

The only conclusion that can truly be made here is that house price comparisons between the UK and Australia are difficult to say the least. Seems to me though that:

- People say, and quite rightly too, that houses in Sydney are ridiculously expensive. But when you compare just over $1 million with London prices of anywhere between £455,000 and £524,000, depending who you believe, then there’s really not much in it.

- If you add up all of the above average prices for the eight Australian capital cities and then divide by 8, you will get an average price of $599,028, not the $695,788 quoted. But Sydney and Melbourne are our two biggest cities and therefore have more houses and they are also far away our most expensive cities. They are our equivalent of London and the South East in the UK; all should be avoided if you are looking for lower housing costs.

- If you take into account that Australian houses are significantly bigger than those in the UK, then maybe the additional cost you might end up paying for a house here in Australia will be worth it.

- If you move from one of the regions in the UK where property prices are low, for example Scotland, Northern Ireland, Wales or the north of England and hoping to move to Sydney, you might find it quite tough. If, on the other hand, you decide to move to one of our large regional cities or even a smaller rural town, you could well be better off.

- If, like me, you move from England’s South East, the most expensive region outside of London and Outer London, and then move to Brisbane, Australia’s third least expensive city, then you will almost certainly get a much bigger house for the same money or less.

So the real conclusions about house prices can only be made by you, according to your circumstances, where you’re coming from and where you are going to.

Hello Bob,

Regarding mortgages (or home loans as I believe you call them!) – in general how readily available are they in Oz compared to the UK?

Also is there any criteria regarding who they are available to – i.e. do you have to have been resident for a certain number of years etc?

They are still called mortgages as well.. they are readily available The better the deposit ratio or deposit to value and employment or something to cover the repayments and you should be ok. You could arguably get an offer of on the day you arrive but that would be pushing it, What I mean there is no term of residence required ….An Australian ID eg Driving license will help that will take a week …Of course it will take a few weeks potentially to find your happy home.

Of course the big freestanding house on a 1/4 acre block is not necessarily for everyone. It is a lot of work: cleaning, gardening, maintenance etc.

We know London prices are insane. If you are leaving behind a typical London apartment (which are tiny), depending upon which area of London it was you can probably rent or buy a lovely modern one or two bedroom apartment in Sydney not too far from the CBD, have more space and have money left over that you didn’t ever know you had.

Average and median house prices are a little misleading. They don’t take into account the proportions of different house sizes in each market. A 1 bedroom apartment would be typical accommodation for many Londoners. In Sydney a 1BR apartment is likely to be much cheaper than the same in London, but there probably aren’t as many of them in Sydney. There will be many more 3 bedroom houses in Sydney though, and this will influence the median house price, so you need to directly compare the type of accommodation to want to the type of accommodation you are leaving rather than compare median house prices.

Absolutely true David, spot on. It is so difficult to compare house prices between countries, especially the UK and Australia. The housing is so different in each country and as you say, simply looking at average and median house prices doesn’t give you the whole picture.

Houses are so much bigger here, on bigger plots of land, and I think it is no exaggeration to say that in some of our cities in Australia the ‘average’ house is more comparable with the kind of house most could never afford in the UK.

As you also say though, big houses aren’t for everyone, we have a lot of houses on acreage here and they do take a lot of work…

https://www.bobinoz.com/blog/13735/the-good-life-in-australia-living-on-acreage/

And if you just want a small house, or an apartment here in Australia, I think you can pick up quite a bargain compared to UK prices at the moment.

Hi Bob,

Interesting read again. Agree with the comments on garden etc. We sold our 1930s semi with 3 beds 1 bath on a 283m2 plot(according to rough measuring on google) before we came out for 185k in the midlands approx 50 minutes to london on the train. We’ve just bought a 3 bed 2 bath with much more usable space inc covered deck on 700m2 for $445k in Melbournes suburban fringe again 50 minutes by train to the CBD. We had previously sold a 4 bed detached in the uk as part of our downsize before coming out (and that was about 300m2 that we sold for 220k.

So ignoring the vagaries of exchange rate, we’ve doubled the land size for a similar capital cost living in a similar commute time.

Of course there are all the other costs/lifestyle choices etc but as a comparison its the best way i can see to do it. When i speak to friends in the uk and they ask about house prices i say that a 3/4 bed house is similarly priced, but generally the rooms are bigger as is the outside space – which as is mentioned above is a much more used asset here.

I agree, I think the main misunderstanding about Australian house prices is that people simply don’t take into account just how big the houses are here. They compare prices, but often don’t realise how much of a bigger house you get here.

I was lucky when I came here back in 2007, firstly because I was coming from the expensive south-east of England and because I did own a ‘big’ English detached house, but then I came here to Brisbane and bought an even bigger house, much much bigger, on three quarters of an acre of land for two thirds of the price I sold my UK home for.

I don’t think I could afford to buy the house I live in here if it were back in the UK, certainly not if it was in the south-east. I think if you choose wisely and if you are realistic about where you want to live, you can certainly get a better house here for the same money.

Thanks for putting that together, Bob. It’s a very interesting read.

When we moved here we left a £400,000 4 bed detached house in the South East and bought a $370,000 4 bed detached house in the far SW of Australia, not near Perth, but not totally remote, either, with a slightly bigger garden. The way it has worked out for us, we feel that the cost of housing here compared to the UK is relatively low; as you’ve mentioned, you get generous living space and garden for comparatively far less.

Another thing to consider is that the gardens here serve a slightly different function, as generally your garden is a true extension of your living space- I am no longer surprised to see sofas on verandahs. As you know, in the UK this would be impossible (due to mould)- and pointless (due to the inclement weather- who wants to sit outside when it’s 10 degrees and drizzling?)

I think that gardens in Australia are arguably a part of your house- your living space, so to speak, and add extra to your quality of life in a way that is different to gardens in England.

We certainly feel we have got a lot for our money, though thank goodness we bought the house here before the pound fell to 1.8! ?

With us, we’ll be staying with family on arriving in Australia and then renting shortly afterwards, then looking at building a house. Hopefully we can keep some money in a UK account and transfer it over when the exchange rate looks better.

But you’re right in regards to the garden – we’ve been looking at some homes and plots and getting a big back garden (not fussed about the front, so long as there’s room for a driveway) is something we’re definitely after. We’d like a pool, some grassy area for kids to play on, and an area for entertaining. My family in Australia spend a lot of time in the garden and we’d like to as well. Here in the UK, the gardens we have are more or less ignored until it’s time to cut the grass or weed them (as well as clear up the litter that blows in – I’ve found some highly suspicious things that have ended up in our gardens before).

By some extraordinary coincidence you have both reminded me of another magazine article I wrote a while back, it was called the outdoor room or something like that…

https://www.bobinoz.com/blog/11472/the-outdoor-room-an-essential-australian-living-area/

Without doubt the outdoor area of the house here is pretty important, you want to be looking for a little bit of quiet exclusion, a nice roofed patio area with a high ceiling if possible, a decent patch of grass, maybe a swimming pool and somewhere nice to sit around and chat.

When people come round for drinks or food, it all happens in the garden, nobody ever stays in the house.

Thanks for your comment. We are renting at the moment but do hope to buy in the future (still in the process of selling our house in the UK) and I didn’t realise how big it is here to build your own home (at least 10 in stages of being built on our school run) to build your home and very much appeals. If you do get to the stage where you are building, it would be good to share your experiences!

I thought about buying a house in Perth for the last few years now. But with median house prices around half a million dollar and a diminishing economy that would be quite risky. Since the mining boom has inflated not only house prices it would probably take a while before prices normalize. As Bob wrote in his article the information differ heavily depending on the source. One says house prices have fallen as much as 6% over the last year while other say just 2%. Another factor for the comparison is the general infrastructure. I would assume that the UK is a big step ahead of Australia in terms of things like power distribution, internet speeds, public transport, public roads etc.

It’s pretty much impossible to really predict house prices, but I tend to agree with you about Perth. House prices did soar during the mining boom, but that appears to be over now and I think those prices still have a fair way to adjust downwards before they level out.

But then, as I say, it’s really in possible to predict the future. In terms of power distribution and internet speeds, the UK are ahead of us simply because that country is more compact, but some of our cities have pretty good public transport and I’d rather drive on our open roads with less traffic than those in the UK.

Just to give my perspective.

I’ve just sold my UK home – a 3 bed through terrace about 15/20 minutes walk from a major city centre, in Yorkshire. Bought in 2008 for £100k, sold (well, in the process) for £100k (which is above the average for the area).

Moving to an area about an hour’s drive from Melbourne and we’re anticipating probably $350-$400k for a new-build that’s a nice decent size, including land.

Even given the generous exchange rate (or not so generous at the moment) that seems like a big step up, but we need to remember that I’ll be earning more than twice what I’m on here, the house will be several times bigger and better, and both my sisters (who are on a lot less, with more kids) have done the same.

So, looking long-term, although your probably need to borrow more money than you did for your UK home, there is every chance you will pay off quicker or at least at the same rate here in Australia as you would have done in the UK.

And you get to live in a bigger house.

Your comment reminded me of an article I wrote for the magazine, it was about financial winners and losers, in terms of people moving to Australia. You might like to read it if you haven’t already; I obviously don’t know your full circumstances, but I think I know enough to believe you will end up on the winners side…

https://www.bobinoz.com/blog/11061/moving-to-australia-financial-winners-and-losers/